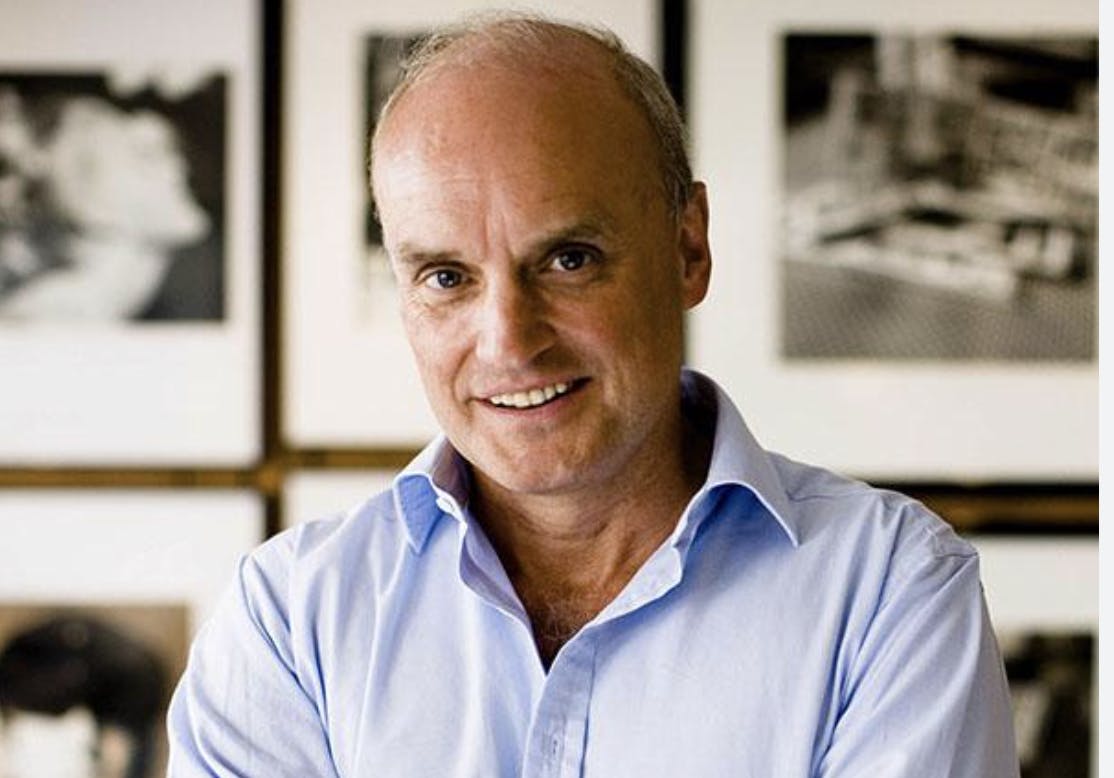

153. Phil Walker CBE: University boards: lessons in stakeholder management, ethical decision-making and data points

Phil Walker CBE is Chair of Council at the University of Roehampton and member of the England & Wales Cricket Board. Formerly, he was COO at Capgemini. Tune in to hear his thoughts on: Phil’s journey into the boardroom (02:02) How university governance differs from corporate (03:15) Key stakeholders for higher education boards (04:23) Heuristics Phil uses to understand university boards (05:30) Key data points every education board should look at (07:45) Three defining moments that most shape how Phil operates as a board member (11:25) Lessons in crisis management from Covid (15:08) The role of summation in effective chairing (16:56) Why Phil thinks boards need to become less formal and more human (21:19) The board’s role in ethical decisions - why Roehampton banned fossil fuel companies from career fairs (26:04) How Phil’s thinking about AI (32:06) Advice for university board candidates (34:58) How Phil thinks about board composition (36:40)⚡The Lightning Round ⚡(38:10)

Listen