Given extremely-cheap valuations in Europe, is it time to ask if there could be an upside surprise coming?

Perhaps winter will bring the war’s participants to the negotiating table? In this report, we list the pros and cons for investing in Europe with suggestions for those who want or need participation.

The U.S. equity market is overshadowed by major risks: the stock market relative to GDP is near historic highs (150% of GDP), the USD Index (DXY) is near 20-year highs and the great tech bubble is bursting. Also, markets outside the U.S. are showing improved relative strength versus the U.S. Accordingly, being positioned in sectors outside the U.S. could be very timely.

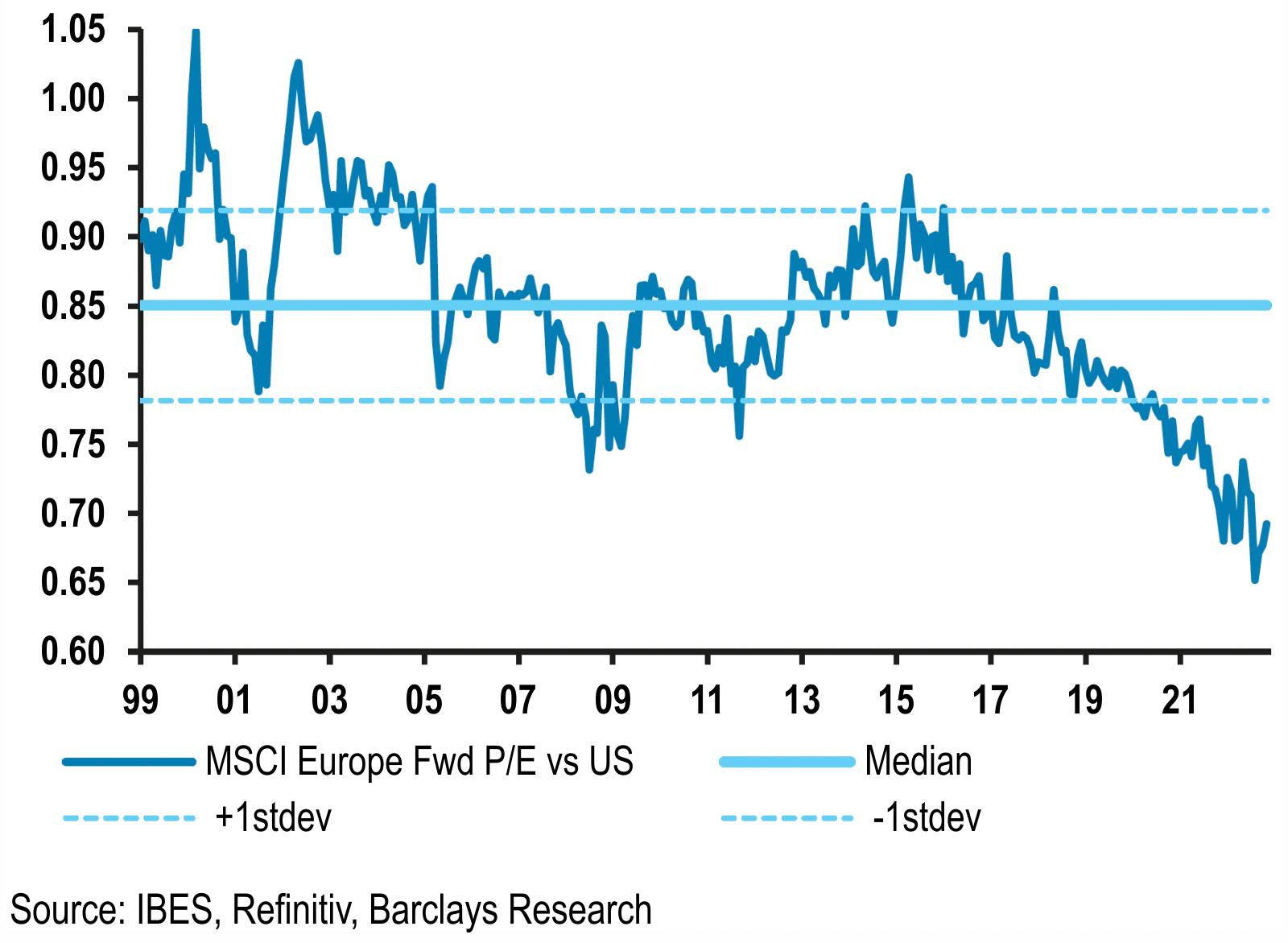

Europe offers a historic discount to the U.S. and it could be a leading beneficiary, if something goes right there. (See chart below.)

Source: Barclays Research

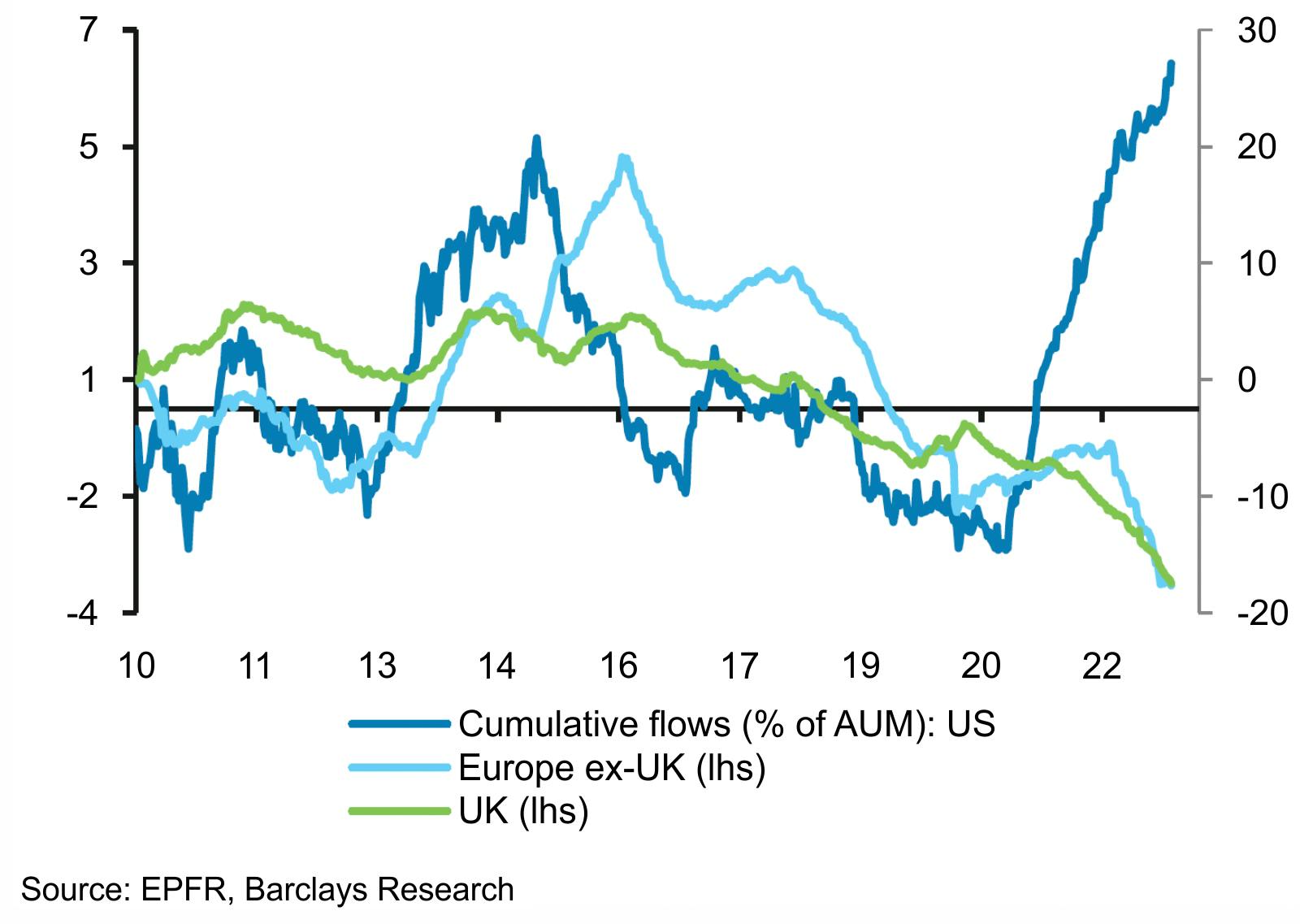

We see in the following chart that the U.S. is over-owned and Europe under-owned. Even during the dark days of the Eurozone Debt Crisis, the market was never as biased against Europe in favour of the U.S. as it is today.

Source: Barclays Research

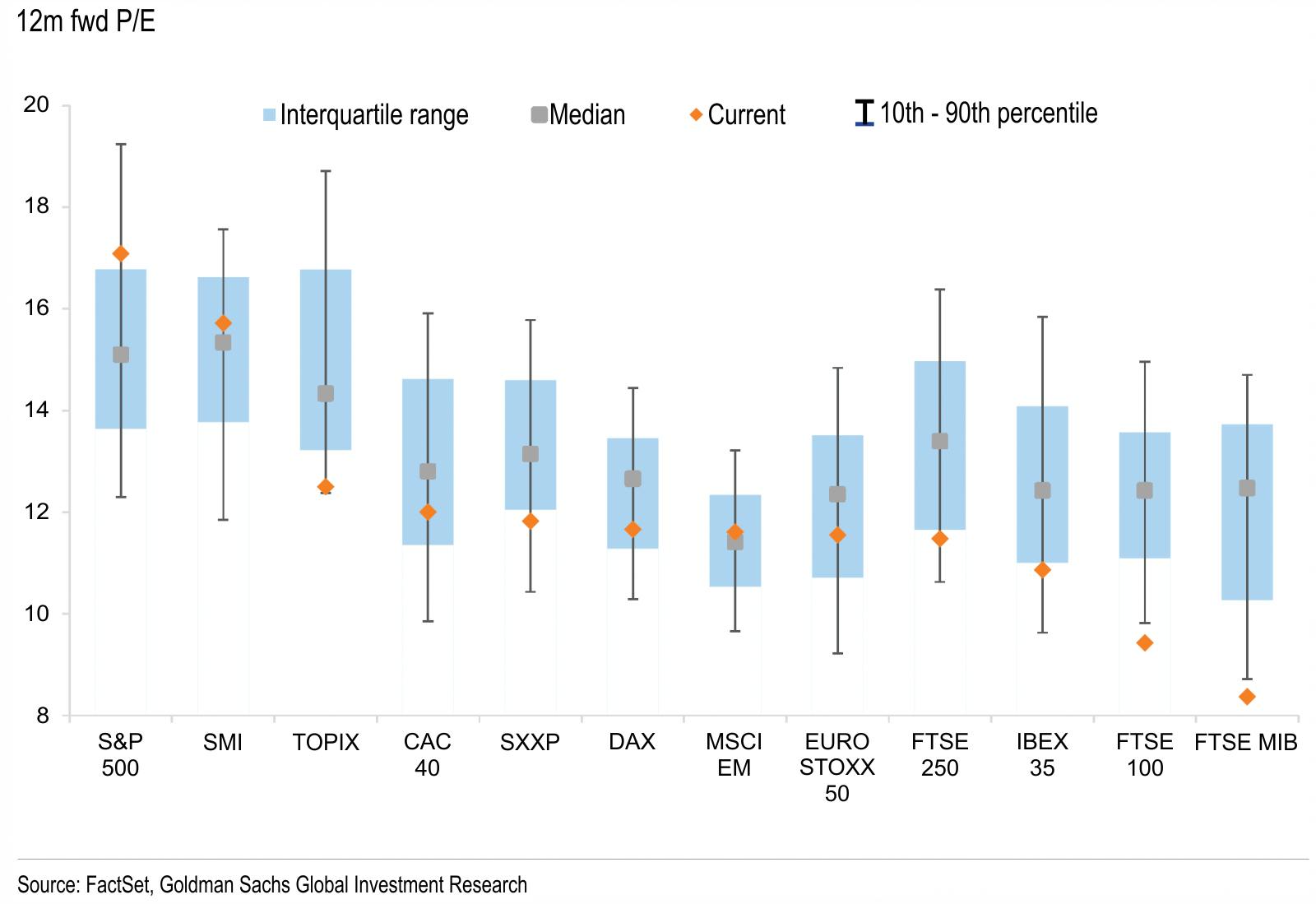

From a valuation perspective, European equities look attractive. The long-term average P/E ratio in Europe is around 15 but the 12-month forward P/E currently sits just under 12. As we see in the chart below, this discount extends across all major indices in Europe.

Source: Goldman Sachs Global Investment Research

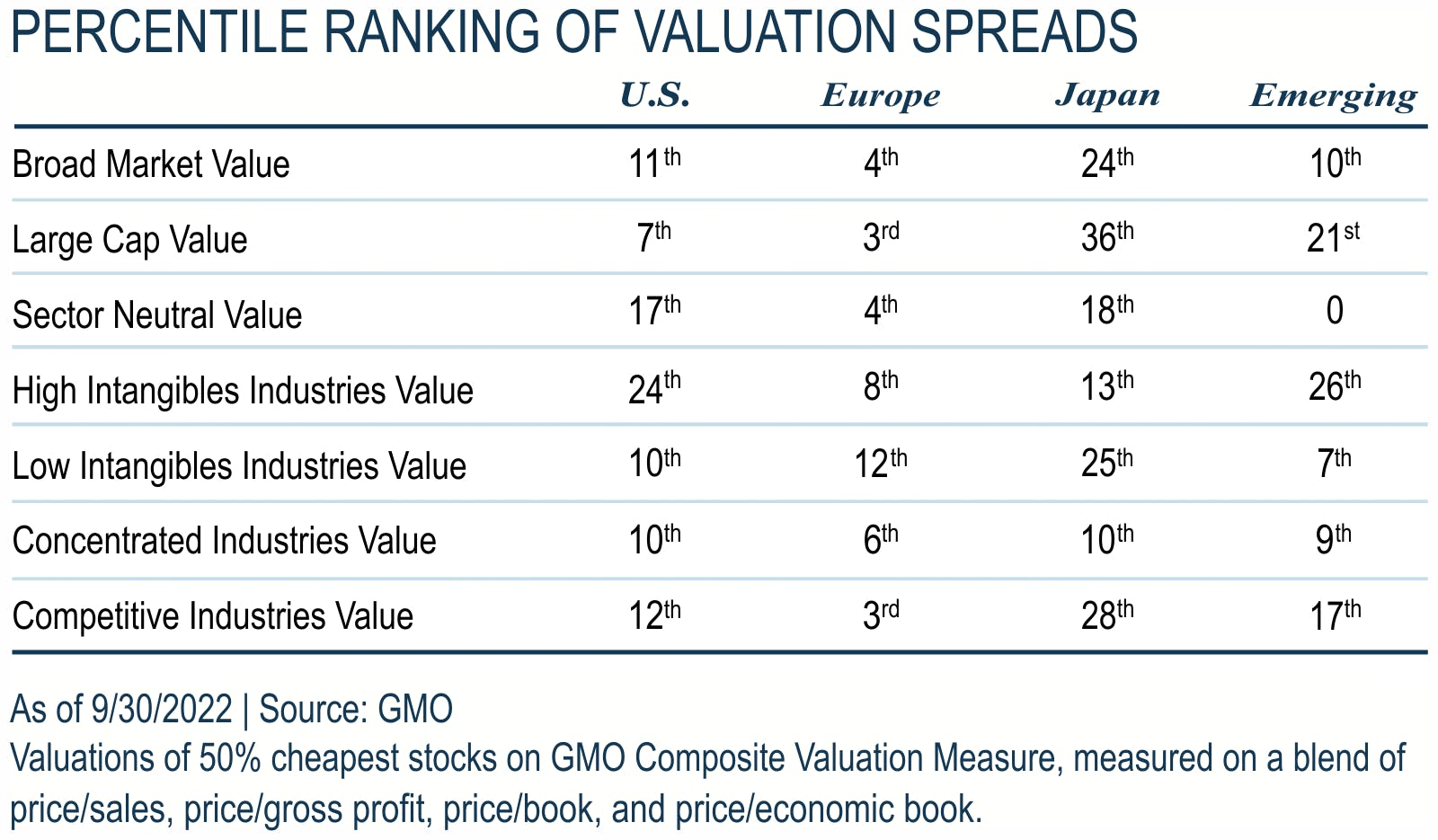

The following chart tells us that when studying the percentile rankings for value versus growth, Europe offers the world’s most extreme value spread.

Source: GMO

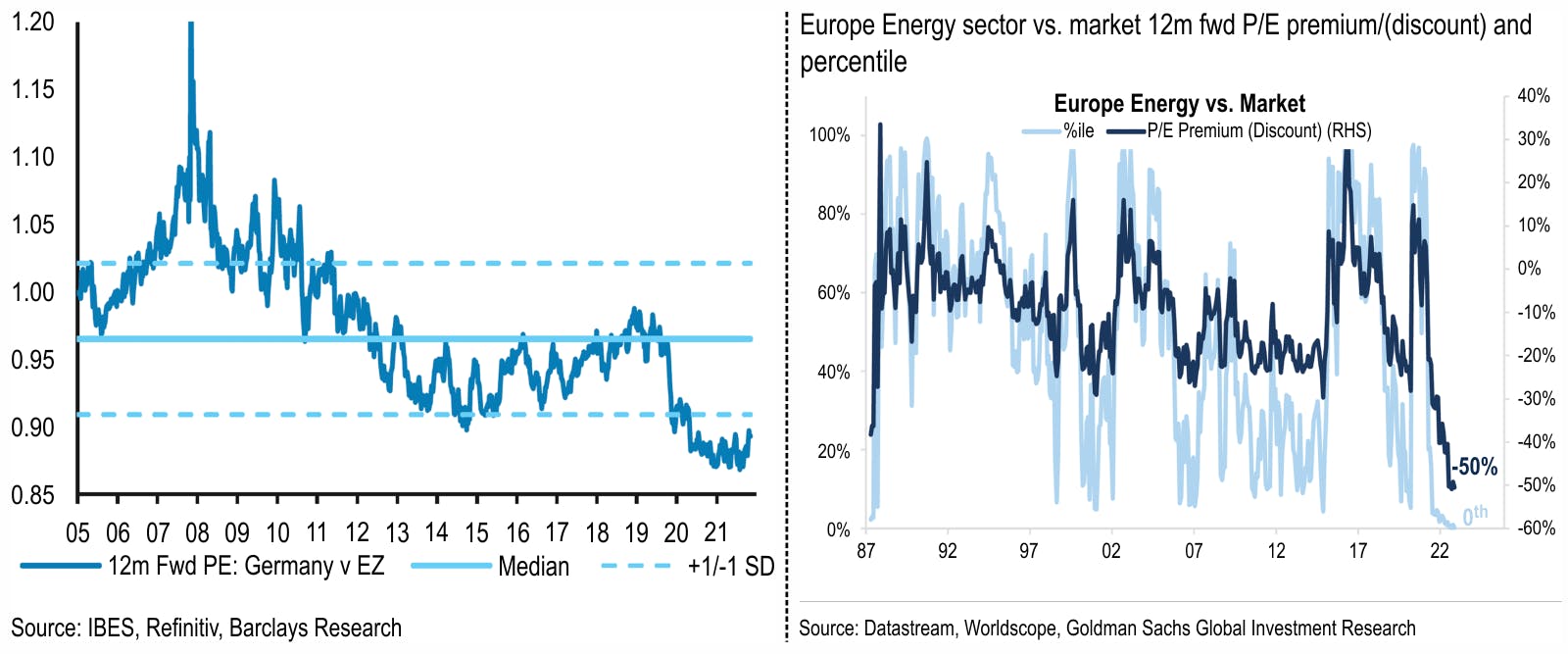

There are also examples of extreme pockets of relative-value within countries and sectors. For example, in the chart on the left-hand side, we see that German equities trade at a record P/E discount compared to the rest of the Eurozone. In the chart on the right-hand side, we see that the energy sector trades at a 50% P/E discount compared to the market.

Source: Barclays Research (Left) & Goldman Sachs Global Investment Research (Right)

As we have seen since the end of September, a breakdown in DXY is bullish for European equities, particularly as domestic European equities track the EUR/USD rate very closely.

European equities will also benefit from China’s reopening. Consider that the Stoxx 600 derives 20% of its sales from the Asia-Pacific.

Also, any sign of de-escalation between Ukraine and Russia will be very bullish for European equities. We are potentially seeing very early signs of a more pragmatic approach being taken by the West.

Last week, in a joint news conference with Macron, Biden said that he is “happy to sit down with Putin to see what he wants” if “there is an interest in him deciding he’s looking for a way to end the war.”

Macron also gave an interview to a French TV channel in which he said that in a “security architecture for tomorrow”, “one of the essential points we must address—as President Putin has always said—is the fear that NATO comes right up to its doors, and the deployment of weapons that could threaten Russia.” Adding that this “will be part of the topics for peace, so we need to prepare what we are ready to do, how we protect our allies and member states, and how to give guarantees to Russia the day it returns to the negotiating table.”

We have long held the view that deteriorating economic conditions ultimately will force Europe to concede on sanctions. Any reversal will be bullish for European equities.

What are the negatives?

Russia, as the world’s energy source, is still essentially in charge of Europe’s industrial production. This is particularly true for Germany, which built its competitive manufacturing sector on the back of cheap Russian gas. BASF, the world’s largest chemicals producer and a single point of failure, is perfect example of this.

According to ICIS, a commodity analytics company, compared to the five-year average, Europe reduced gas demand by 24% last month. However, this was aided by an unseasonably-warm autumn and there are many reasons to believe that the outlook remains dark. Javier Blas writes in Bloomberg that compared to the period from 2000 to 2020, gas prices today are still seven times higher. And winter is just beginning. To underscore the fragile nature of the energy market, electricity prices last week in the Nordic region surged to €318 per MWh, recording the third-highest weekly price ever.

Last week, Germany also produced 40% of its electricity from coal plants.

As we have written, Europe is running the post-WW1 Germany playbook, which is highly inflationary. Consider that just as growth in Europe is being sacrificed in support of Ukraine [EU officials suggest not using energy is a way out of the crisis], spending remains unsustainably high.

Consider that according to Bruegel, a think-tank, since last September, €600.4 billion has been handed-out or allocated in the form of subsidies to households and businesses in the EU to shield them from high gas and electricity prices. Of this, Germany alone accounts for €264 billion. These subsidies are finite and at some point the public will have to bear the cost, which will hit economic growth.

The potential length of the Ukraine war and the corresponding sanctions on Russia are key considerations when producing growth forecasts. As Blas writes,“although prices are lower than in July and August, they remain high enough to kill the manufacturing sector. When Russia invaded Ukraine in late February, many executives braced themselves for a six-week energy crisis; soon, they realized it would last at least six months. Now they fear it’s going to be six years.”

European competitiveness is bearing the brunt of the Ukraine war which is posing an existential threat to Europe’s, particularly Germany’s, competitiveness.

Recently, Thomas Schaefer one of the most senior executives at Volkswagen, warned that “Germany and the European Union are rapidly losing their attractiveness and competitiveness…When it comes to the cost of electricity and gas, in particular, we are losing more and more ground. Unless we manage to reduce energy prices in Germany and Europe quickly and reliably, investments in energy-intensive production or new battery cell factories in Germany and the EU will be practically unviable. The value creation in this area will take place elsewhere.”

Other headwinds to European equities include rates turning restrictive to combat inflation, as warned by ECB board members. Also, according to Goldman Sachs’ calculations, in an average European recession, earnings would typically fall by 30%.

Implied valuations and commensurate outflows discount a grave and lasting crisis in Europe.

For those looking for exposure to Europe it may be worthwhile to look at:

- Greece, whose economic and political cycles are running contrary to the rest of the world.

- European stocks exposed to China reopening

- Companies with strong balance sheets and high margins. Cheap credit since the GFC has accelerated the rise of zombie companies which will suffer as rates rise.

- Commodity sectors and related stocks.

- Domestic-focused European companies as the euro rises against the U.S dollar.

- Equities in strategically important sectors. The post-GFC era has been characterised by low levels of investment and de-leveraging. As globalisation reverses, as the geopolitical backdrop remains volatile and as supply chain bottlenecks remain, both private and government-sector investment will accelerate, particularly towards domestic European champions.

- Call options on any energy-intensive firms or firms that rely on revenue from Russia.

This article is reproduced with kind permission from 13D Research & Strategy, a top-down, thematic investment research firm. It was founded by Chairman, Kiril Sokoloff, in 1983. At its core, 13D helps its clients detect change within markets before others. 13D’s clients have material interests in capital markets and use 13D to form a differentiated opinion on where major investment opportunities and risks lie. If you would like to learn more about how to become a 13D client, please register your interest here.